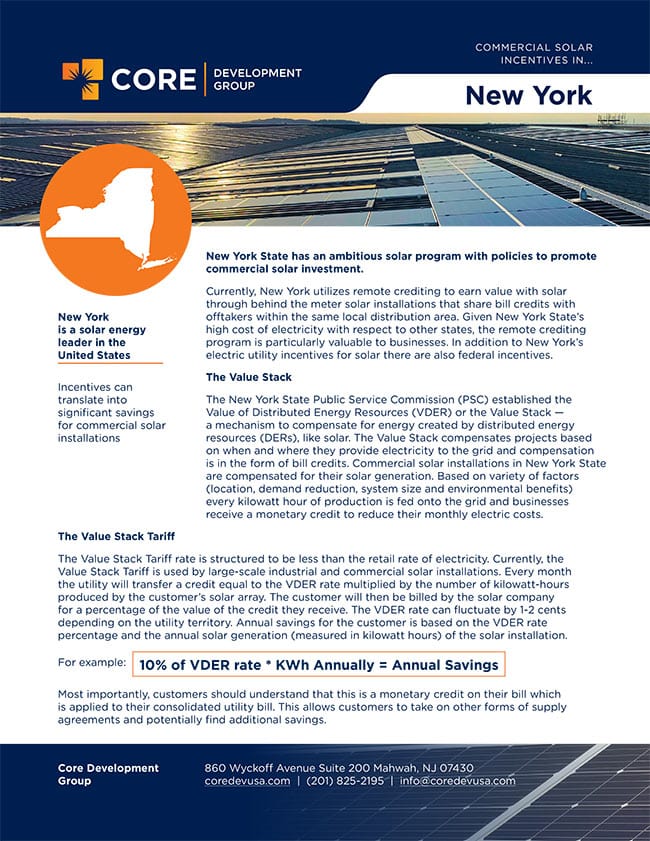

New York Commercial Solar Incentives

NEW YORK is a solar energy leader in the United States

Incentives can translate into significant savings for commercial solar installations.

New York state has an ambitious solar energy program, with policies to promote commercial solar investment. The distributed solar projects associated with expanding the State’s goal from 6 GW by 2025 to 10 GW by 2030 are expected to support private investment, reduce greenhouse gas emissions, bring savings to solar customers and off-takers, create jobs statewide, and generate more clean electricity.

In 2022, NY State Public Service Commission PSC recently approved funding to expand the NY-Sun Program with initial base incentives and various adders intended to ultimately support an additional 3.4 GW distributed solar by 2030. The State estimates these new incentives and planned expansion of the NY-Sun program will provide about $1 billion in incentives across the state with targeted areas such as canopies, community solar, and landfill/brownfield solar development areas.

NY Sun Commercial & Industrial Program

New York Community Solar Program

Through New York’s Community Distributed Generation (CDG) program, also referred to as community solar, residents and businesses can subscribe to receive bill credits virtually from a solar installation within their local utility service territory. Community solar benefits consumers that may be otherwise excluded from the solar market (renters, shaded property, lack of roof control). Subscribers to community solar programs benefit with annual savings on their utility bills. Property owners can sell or lease their property to solar developers who install and maintain the community solar farms anywhere in New York, regardless of the area’s previous function.

New York Remote Crediting

Currently, New York utilizes remote crediting to earn value with solar through behind the meter solar installations that share bill credits with offtakers within the same local distribution area. Given New York State’s high cost of electricity with respect to other states, the remote crediting program is particularly valuable to businesses. In addition to New York’s electric utility incentives for solar, there are also federal incentives.

The Value Stack

The New York State Public Service Commission (PSC) established the Value of Distributed Energy Resources (VDER) or the Value Stack — a mechanism to compensate for energy created by distributed energy resources (DERs), like solar. The Value Stack compensates projects based on when and where they provide electricity to the grid, and compensation is in the form of bill credits. Commercial solar installations in New York State are compensated for their solar generation. Based on a variety of factors (location, demand reduction, system size and environmental benefits) every kilowatt-hour of production is fed onto the grid and businesses receive a monetary credit to reduce their monthly electric costs.

The Value Stack Tariff

The Value Stack Tariff rate is structured to be less than the retail rate of electricity. Currently, the Value Stack Tariff is used by large-scale industrial and commercial solar installations. Every month, the utility will transfer a credit equal to the VDER rate multiplied by the number of kilowatt-hours produced by the customer’s solar array. The customer will then be billed by the solar company for a percentage of the value of the credit they receive. The VDER rate can fluctuate by 1-2 cents depending on the utility territory. Annual savings for the customer is based on the VDER rate percentage and the annual solar generation (measured in kilowatt-hours) of the solar installation.

For example: 10% of VDER rate * KWh Annually = Annual Savings

Most importantly, customers should understand that this is a monetary credit on their bill, which is applied to their consolidated utility bill. This allows customers to take on other forms of supply agreements and potentially find additional savings.

Leasing Your Land for Solar In New York

New York’s solar market is growing fast and demand for sites to install large-scale solar electric systems is high. Across the State, developers are looking for parcels of land — starting at approximately 5 acres — that are suitable for solar arrays.

Not every property is ideal for installing large solar arrays due to property limitations or zoning requirements, but a participating contractor or developer will be able to determine your land’s suitability. There are multiple factors to consider before committing to lease your land for solar development. To fully understand the impact of these factors and income potential for a solar land lease, consult with us.

Federal Investment Tax Credit (ITC)

An incentive program that lowers commercial solar installation costs for New Jersey businesses. Under the Federal ITC program, businesses can receive a 26% tax credit for the installation of a solar project.

Please note, businesses should start commercial solar project construction before the end of 2022 to maximize financial tax credit incentives and savings.

Additional New York Incentives

Local Law 92 94 Adherence Planning — These local laws require that any projects involving structural changes to new or existing roof decks must include the installation of solar photovoltaics or a green roof across all available roof space.

Local Law 97 Carbon Offset Planning — This law aims to place carbon caps on most buildings larger than 25,000 square feet – roughly 50,000 residential and commercial properties across NYC. Beginning in 2024, the law will be enforced through fines based on emissions levels per building.

Learn more about New York Commercial Solar Incentives

Fill out the form below to receive access to the New York Commercial Solar Incentives document.